Mortgage points break even

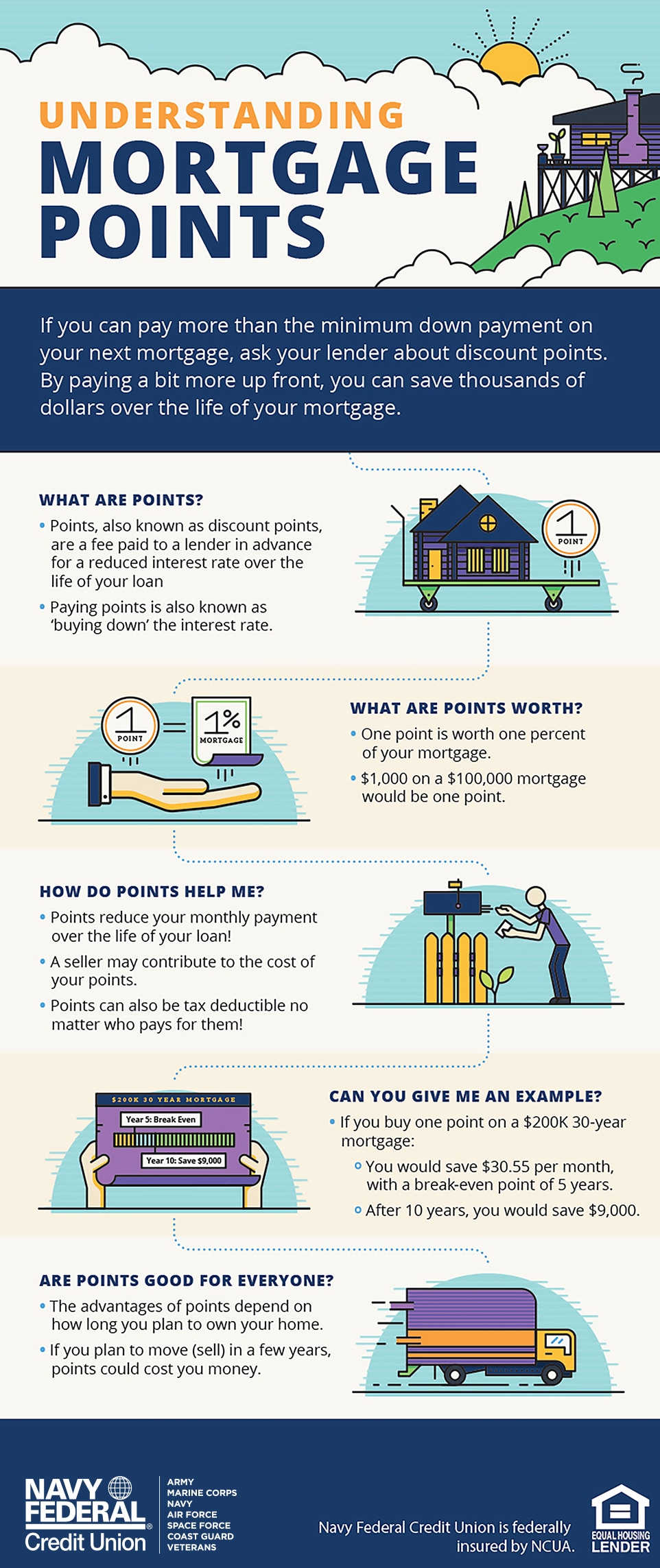

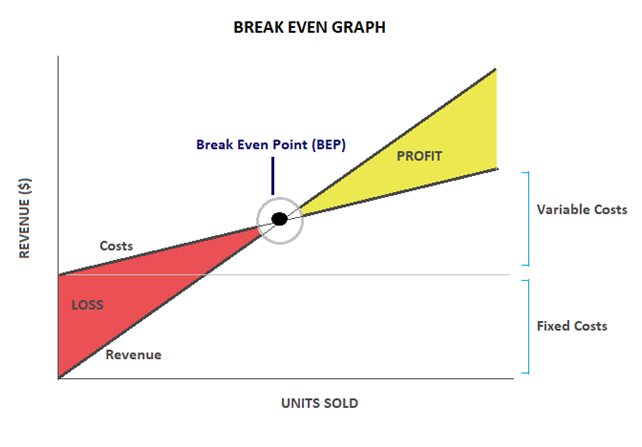

However if points are paid on a home equity loan created after December 15 2017 to improve your home even if you meet tests one through six. The Break Even point is 250 units.

How To Do A Break Even Chart In Excel With Pictures Wikihow

Thats the point when youve paid off the cost of buying the points.

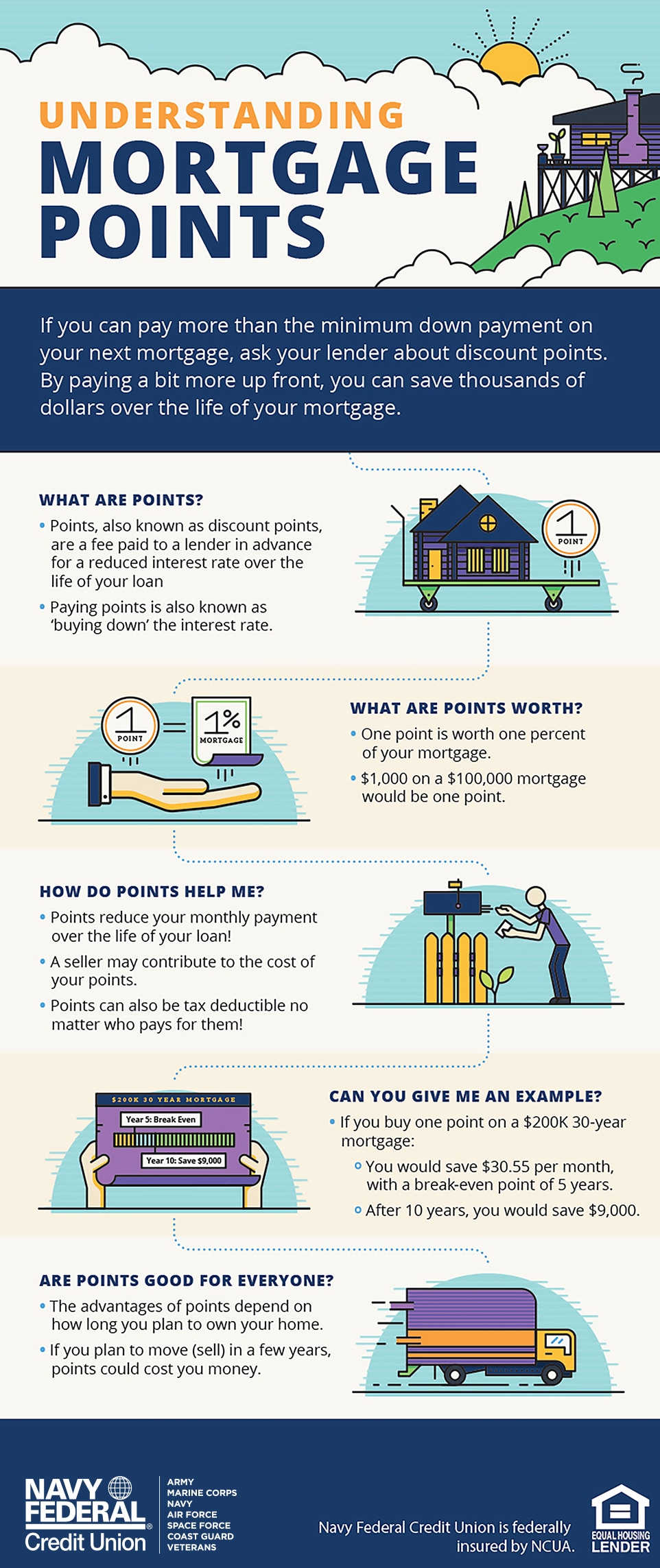

. Defining the Social Security Break-Even Age. Purchasing the three discount points would cost you 3000 in exchange for a savings of 39 per month. The term points is used to describe certain charges paid to obtain a home mortgage.

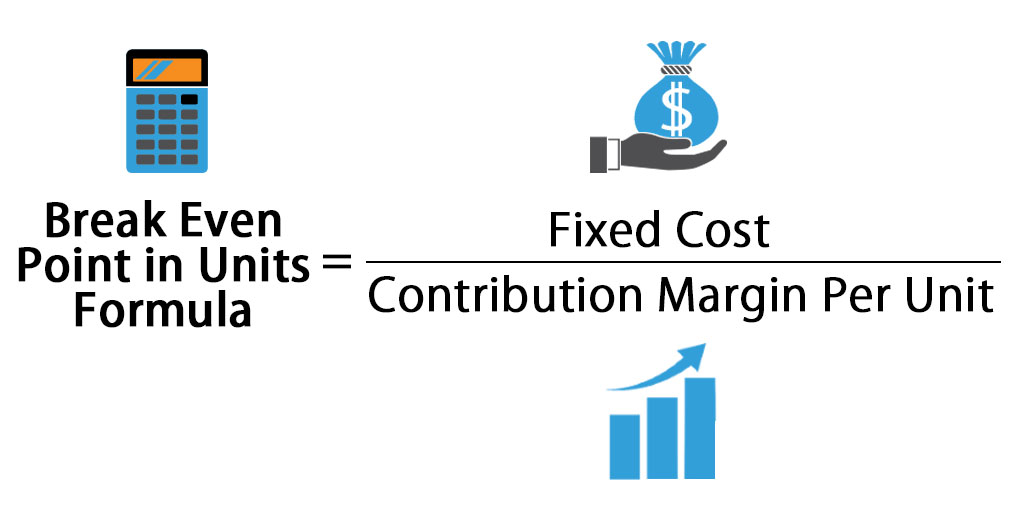

The break-even period is the time it takes to recoup the cost of buying points. Every mortgage loan will have its own break even point for. For example adding 50 each month to your principal payment on the 30-year loan above reduces the term by 3 years and saves you more than 27000 in interest costs.

Break Even Points in Dollars. Your Social Security break-even age represents in theory the ideal point in time to apply for benefits in order to maximize them. Stocks were on pace for a five-day losing streak before a rebound late in the day.

Mortgage discount points explained January 13 2022 You Dont Need A 20 Downpayment To Buy A Home February 20 2019 First Time Home Buyer. For options trading the breakeven point is the market price. Learn how mortgage discount points work and when you should pay for them.

The Break Even formula in sales in dollars is calculated by. Remember you can begin taking your benefits at age 62 at a reduced amount. There are two types of points you can pay on your mortgage loan.

Mortgage closing costs are the fees you pay when you secure a loan either when buying a property or refinancing. Any decision about mortgage points should begin as a one-dimensional question of whether they make sense depending on the break even point says Tom Knoell a Phoenix-based senior loan. When converting basis points to percentages multiply by 100.

Home equity line of credit HELOC A HELOC is a loan secured by the. Breakeven Point - BEP. You should expect to pay between 2 and 5 of your propertys purchase price in.

The first thing to remember when calculating basis points is that one basis point equals 001 or 00001. Discount points - a form of pre-paid interest which gives you a lower interest rate for the remainder of the loan. The Dow Jones Industrial Average was up 04 over 100 points while the SP 500 gained 03 and the tech-heavy.

The current rate on a 51 adjustable-rate mortgage is 493 with 02 points paid 029 percentage points higher than a week ago. By paying a little extra on principal each month you will pay off the loan sooner and reduce the term of your loan. The rate on the 30-year fixed mortgage jumped to 589 from 566 the week prior according to Freddie Mac.

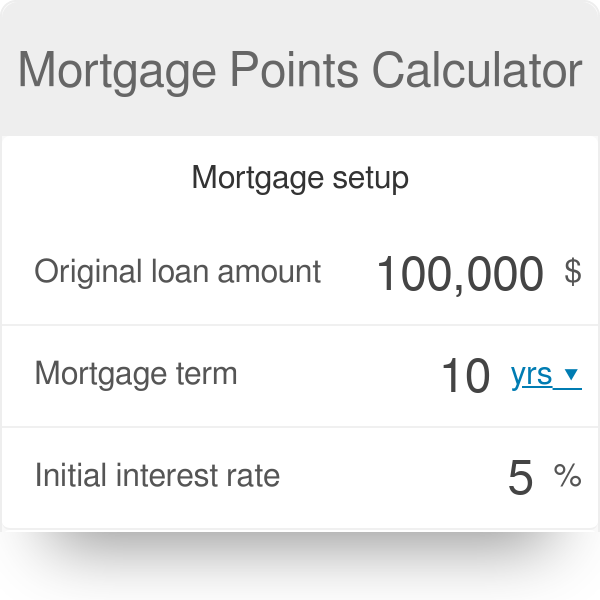

The Early-2017 Guide to Buying a Home March 10 2017. The 15-year rate averaged 212 this week last year. The Should I buy mortgage points calculator determines if buying points pays off by calculating your break-even point.

The breakeven point is the price level at which the market price of a security is equal to the original cost. Origination points - fees that are charged by a mortgage broker or lender for the origination of the loan. Points may also be called loan origination fees maximum loan charges loan discount or discount points.

Buying points to lower your monthly mortgage payments may make sense if you select a fixed-rate mortgage and plan on owning the home after reaching the break-even period. The break-even point is crucial because it helps borrowers determine whether the refinance is worth the cost in the long run. Mortgage rates close in on 6 highest since 2008.

Mortgage points are fees you pay the lender to reduce your interest rate. When converting percentages to basis points divide by 100. Typically when you pay one discount point the lender cuts the interest rate 025.

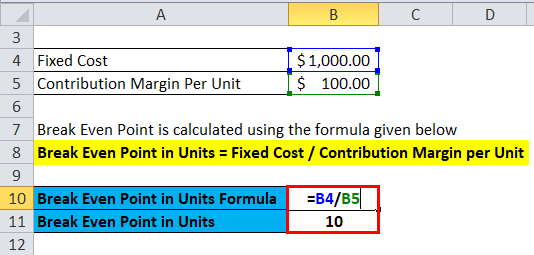

Break Even Point in Units 50000 400 200 Break Even Point in Units 50000 200. Mortgage points let you buy down your interest rate. Break Even Point in Units 250.

So to calculate basis points. But by taking your benefits at this earlier age youll receive more Social Security checks over your lifetime. Determining whether you should pay points on your loan.

Buying points on mortgages with only a few years left or on those with already very low mortgage rates could yield monthly savings of only a few bucks and never reach a break-even point for your. The 15-year rate averaged 212 this week last year. The current rate for a 15-year fixed-rate mortgage is 521 with 09 points paid an increase of 005 percentage points higher week-over-week.

Now lets break down the steps of how to calculate basis points manually. Straight to the Point Valuations. Refinancing is not the only way to decrease the term of your mortgage.

You will need to keep the house for 72 months or six years to break even on the point purchase. The current rate for a 15-year fixed-rate mortgage is 521 with 09 points paid an increase of 005 percentage points higher week-over-week.

Mortgage Discount Points Calculator Mortgage Calculator

Calculate Mortgage Discount Points Breakeven Date Should I Pay Points On My Home Loan

How Do Mortgage Points Work Navy Federal Credit Union

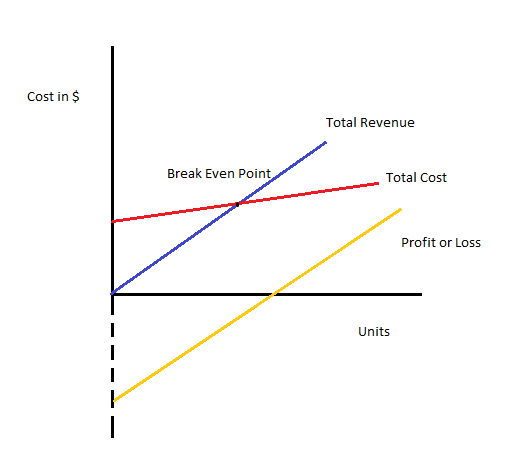

Break Even Analysis Formula Calculator Excel Template

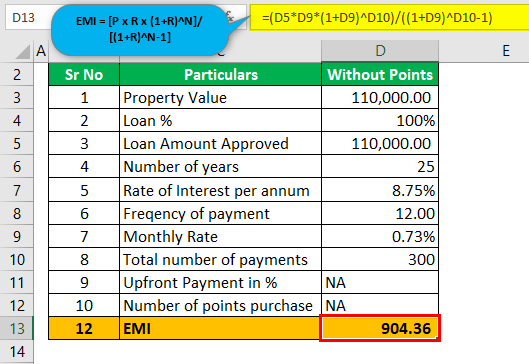

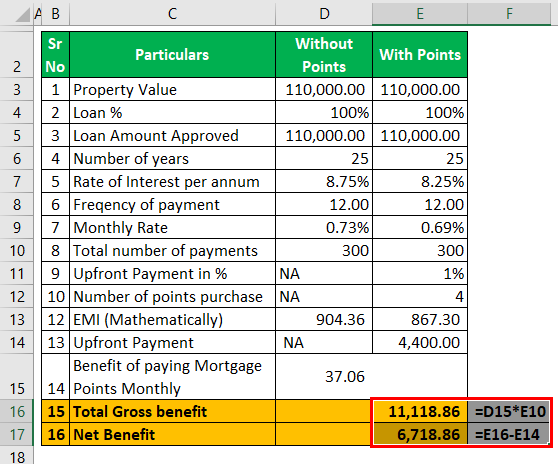

Mortgage Points Calculator Calculate Emi With Without Points

Mortgage Points Calculator Calculate Emi With Without Points

Break Even Sales Formula Calculator Examples With Excel Template

Break Even Analysis Formula Calculator Excel Template

Break Even Sales Calculator

Mortgage Points A Complete Guide Rocket Mortgage

![]()

Discount Points Break Even Calculator Home Mortgage Discount Points Explained

Break Even Analysis Formula Calculator Excel Template

Break Even Analysis Formula Calculator Excel Template

Mortgage Points Calculator

Mortgage Points Calculator 2022 Complete Guide Casaplorer

Mortgage Points A Complete Guide Rocket Mortgage

Mortgage Points Calculator Calculate Emi With Without Points